21-Jul-2025

Unified Payments Interface (UPI)

Economics

Why in News?

India has been recognized as the global leader in fast payments, as highlighted in a recent International Monetary Fund (IMF) report titled "Growing Retail Digital Payments: The Value of Interoperability."

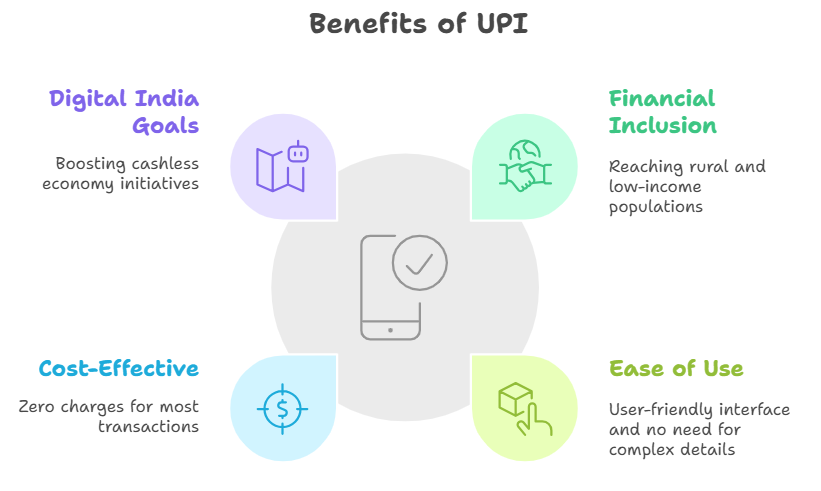

About Unified Payments Interface (UPI)

- UPI was developed by the National Payments Corporation of India (NPCI) in 2016.

- UPI allows users to link multiple bank accounts into a single mobile app from any participating bank.

- It combines various banking features, such as fund transfers, into one platform.

- It is based on the Immediate Payment Service (IMPS) infrastructure.

- UPI is the world’s most successful real-time payment system, known for its simplicity, safety, and security.

- It supports both person-to-person (P2P) and person-to-merchant (P2M) transactions.

Image Courtesy: NPCI and PIB

|

National Payments Corporation of India (NPCI)

|

Preparing Through MCQ

Q. Who developed the Unified Payments Interface (UPI) in India?

(1) Reserve Bank of India (RBI)

(2) Indian Banks' Association (IBA)

(3) Ministry of Finance

(4) National Payments Corporation of India (NPCI)

Answer: (4) National Payments Corporation of India (NPCI)